The success of your business is as strong as the foundation of which it is built upon. Having a good understanding of the legal aspect of your business is crucial for lasting success. Begin considering the expenses required to start your business as investments as opposed to expenses. Although you may not receive a direct return immediately, you will rest assured knowing that you are operating within guidelines, and are providing your clients with a professional product. In other words, don’t skip this stuff!

In this blog post, we will cover several aspects of the startup phase of your painting business. Some things we will learn:

- What to name your business & purchasing a domain name

- How to set up an EIN or Employer Identification Number

- State licensing and requirements

- How to set up your Articles of Incorporation

- How to classify your business (LLC vs Corporation)

- Tax 101

- Understanding Tax Deductions

- Insurance & Workers Comp

- Banking

- The Power of Outsourcing Accounting & Payroll

- Employee Classification

1. Choose a name for your painting business

When choosing a name for your painting business, it’s important to choose something that allows you to “act big” when you’re small . For me, I named my business “Premium Painting”. I wanted to give homeowners a feeling that they are working with a professional brand right off the bat. For you, I recommend you choose something “bigger” than you. What I mean is, avoid using your first or last name in the company name (ex. John Williams Painting). Think of a landmark in your hometown, or something relevant in your area that will spark someone’s attention. For example “Blue Hills Painting” or “Green Line Painting”.

Remember, in order to have lasting success and to maximize efficiency, our goal is to zero-in on one specific task: House painting, nothing else. With that said, always include just the word “Painting” in the company name.

The goal is that we want our homeowners to be able to find us as easily as possible when searching online, and we also want them to know exactly what we specialize in. Eliminating confusion in the marketplace will set you apart from the competition big time. Try to avoid names like (Blue Hills Painting & Pressure Washing, or (Blue Hills Painting & Cabinetry, Blue Hills Contracting, Blue Hills Home Services, etc.)

Purchasing business domain (GoDaddy.com)

GoDaddy is a domain broker that will help you find a domain for your business. Your website is your 24/7 online salesperson, we will dive deeper into website creation, hosting, and other online specifics later on. For now, it’s important to at least grab the website domain for your business.

- The Domain is what people type in to go to your website like ( www.Facebook.com )

- This does not have to match the business name exactly! When I first started my business, PremiumPainting.com was $5000! So, I got creative and now my website is (PaintPremium.com) and my business name is (Premium Painting, Inc.)

- Get creative - For our sample above, if “BlueHillsPainting.com” is not available and you live in Pennsylvania, try “BlueHillsPaintingPA.com”

2. Figure Out State Licensing & Requirements Info

In order to have a long-lasting, efficient business that will attract quality clients and employees, it’s important to have all of your ducks in a row. Skipping legal licensing may be beneficial in the beginning, but could really come back to haunt you in the future. Take care of the licensing requirements for your state, this way you can focus on growing your business - not worrying if you will get caught operating illegally!

Here’s a link that will help you understand some of the legal requirements for your state:

Visit State Licensing Requirements for information on the requirements for your state. Some states do not require licensing for certain trades, like painting in Florida. We’re just required to register with the county we are operating in. Each state has a list of requirements for you to properly start your business. I will be going over the basics assuming that you have appropriate licensing for your state.

3. Apply for your EIN (Tax ID)

Your EIN is your “Employer Identification Number”. Think of this as the “Social Security Number” For your business. When you own a business that is classified as an LLC or Corporation, you are responsible to file taxes on behalf of the business and for yourself personally. The EIN allows you to separate the two.

Remember, applying for an EIN is only necessary if you designate as a LLC or a Corporation. A sole proprietorship or single-member LLC taxed as sole-prop should use the owner's SSN or apply for a TIN (Tax Identification Number).

The IRS would prefer a Single Member LLC taxed as sole-prop to NOT use a separate EIN. If a company is a corporation or an LLC taxed as a corporation (either S corp or C corp) then it would require an EIN.

Applying for an EIN is super easy, visit this link to apply for an EIN Application: EIN Application

4. Apply for Articles of Organization or Incorporation ( difference between LLC & CORPORATION )

This step is how we let the state know you are starting a business. Each state is different, however, Google makes it easy to find exactly what we are looking for. Here’s the steps to get started.

- Type into Google (“ Your State ” Secretary of State)

- Click the link that shows the website for your state

- Find a “Start a business” link, or something similar that allows you to choose your designation. See the next section to help you classify your business.

5. Classify Your Business

Understanding how you want to classify your business is key for tax reporting purposes. It’s important for you to first decide whether you want to classify as a Sole Proprietorship, LLC, or a Corporation.

First, let's discuss a Sole Proprietorship. A Sole Proprietorship is a great way to get started to avoid the costs of reporting and filing to be a LLC & S-Corporation. If you do not plan to have at least $30,000 in profit your first year in business, than this is a great option for you.

However, if you're planning to exceed $30,000 in profit, you may want to look into classifying as a S-Corporation or an LLC.

By classifying as one of these two entities, you unlock significant tax breaks and benefits that aren't available to a Sole Proprietorship.

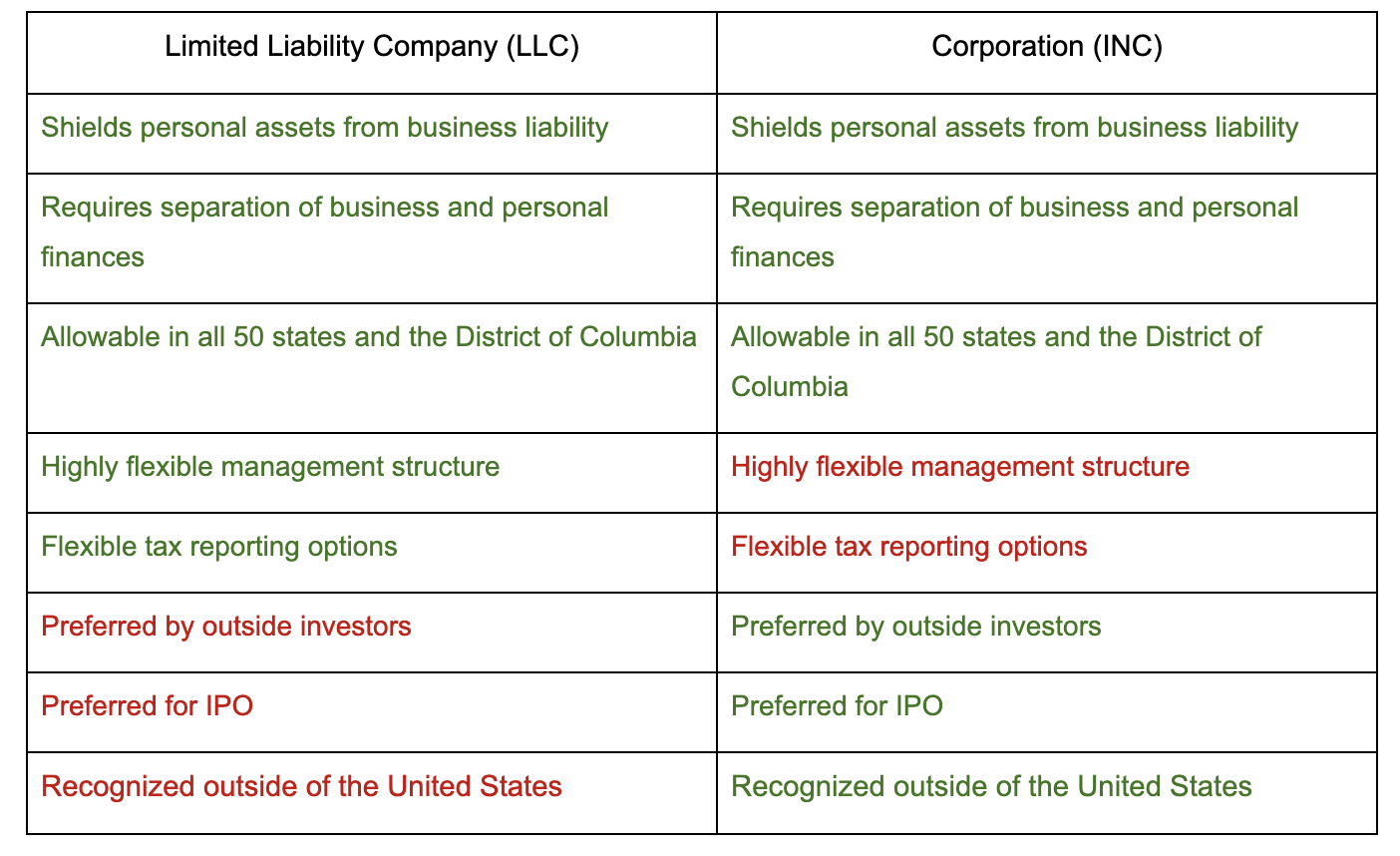

Before making your decision to classify as an LLC or Corporation, take a look at some key differences:

After you create your corporation or LLC, you now have the opportunity to decide how you’d like your business to be taxed.

If you’re a single owner LLC, you can be taxed as a sole proprietorship or a corporation. LLC’s with more than one owner can be taxed either as a partnership or a corporation. Income from LLCs treated as sole proprietorships or partnerships is reported directly to the owner’s individual tax returns.

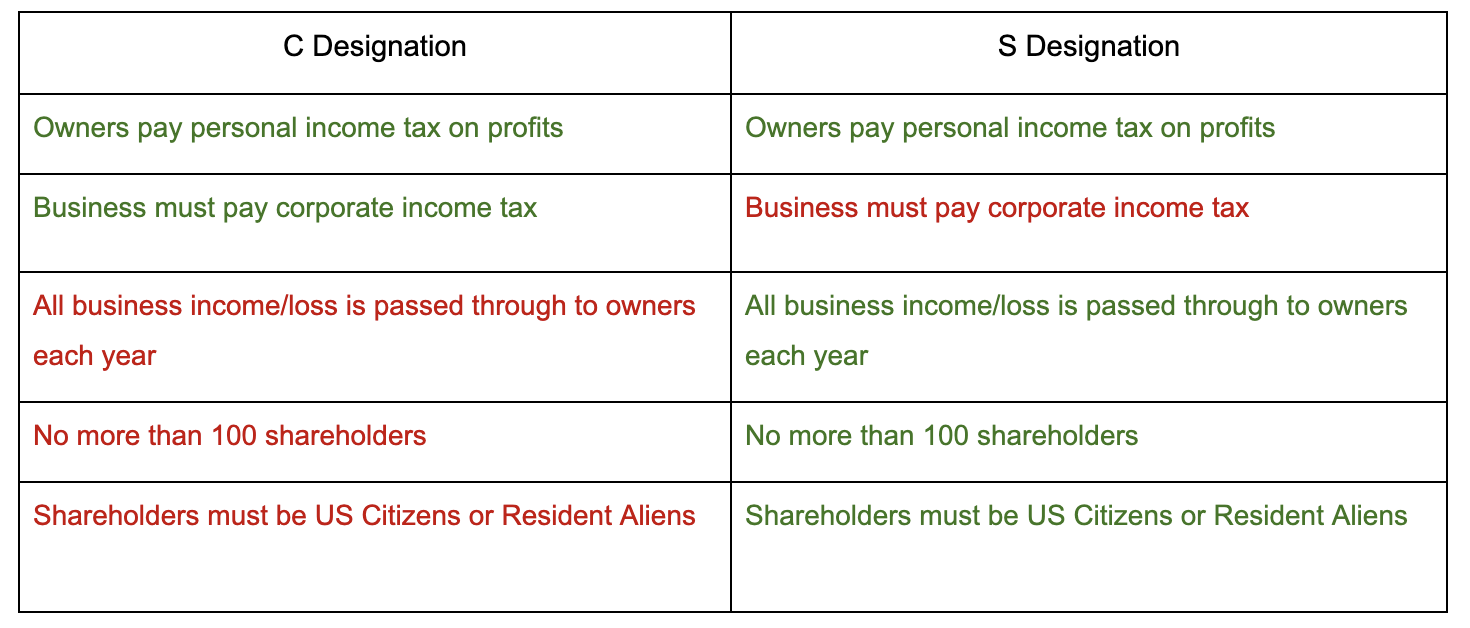

S-Corporation or C-Corporation

The IRS allows you 75 days since the start of your business of the fiscal year to file forms indicating that you plan to elect as an S-Corp. However, businesses can change how they are taxed at almost any time.

If you are planning on scaling your company fast, I recommend a classifying as an “S-Corporation”, for the ability to avoid paying the corporate income tax. Often times S-Corp is a good choice for small businesses, however, it may be in your best interest to consult with a tax-professional familiar with your state guidelines to determine if an S-Corp is in your best interest specifically.

6. Understand What Taxes You're Responsible For

Making the transition from employee to employer, it is important to understand what taxes your business is responsible to pay. When I first started my business, I was able to accurately price my painting jobs because I had the knowledge of what I was required to pay so I made sure to factor that into my pricing.

Regardless if you make a profit or not, all businesses are required to file a yearly income tax return. Depending on which designation you choose, this tax will either be apart of your individual return , or a separate one for your company. Below, I will outline the different types of taxation, their definitions, and how they will affect your business. Keep in mind, that each state is different, and it would be wise to consult a tax professional or accountant for further classification about your state’s requirements.

Federal Income Tax

Employers generally must withhold federal income tax from employees' wages. To figure out how much tax to withhold, use the employee's Form W-4, Employee’s Withholding Certificate, the appropriate method and the appropriate withholding table described in Publication 15-T, Federal Income Tax Withholding Methods.

Social Security and Medicare Taxes

An employer generally must withhold social security and Medicare taxes from employees' wages and pay the employer share of these taxes.

Social security and Medicare taxes have different rates and only the social security tax has a wage base limit. The wage base limit is the maximum wage subject to the tax for the year. Determine the amount of withholding for social security and Medicare taxes by multiplying each payment by the employee tax rate.

For the current year social security wage base limit and social security and Medicare tax rates refer to Publication 15, (Circular E), Employer's Tax Guide.

Additional Medicare Tax

In additional to Medicare tax, employers are responsible for withholding the 0.9% Additional Medicare Tax on an employee's wages and compensation that exceeds $200,000 in a calendar year. You must begin withholding Additional Medicare Tax in the pay period in which you pay wages in excess of $200,000 to an employee and continue to withhold it each pay period until the end of the calendar year. There is no employer match for the Additional Medicare Tax.

For additional information see our questions and answers for Additional Medicare Tax and Publication 15.

Federal Unemployment (FUTA) Tax

Employer’s report and pay FUTA tax separately from Federal Income tax, and social security and Medicare taxes. You pay FUTA tax only from your own funds. Employees do not pay this tax or have it withheld from their pay. Refer to Publication 15 and Publication 15-A, Employer's Supplemental Tax Guide for more information on FUTA tax.

Depositing Employment Taxes

In general, you must deposit federal income tax withheld as well as the employer and employee social security and Medicare taxes and FUTA taxes. The requirements for depositing, as explained in Publication 15, vary based on your business and the amount you withhold.

Self-Employment Tax

Self-Employment Tax (SE tax) is a social security and Medicare tax primarily for individuals who work for themselves. It is similar to the social security and Medicare taxes withheld from the pay of most employees.

Although this tax is filed yearly, income tax is paid as the income is earned throughout the year. Employees fill out a “W4” form which allows them to decide how they want their taxes paid.

A good accountant will help you outline estimated tax payments for the year to help you ensure that you can manage the tax liability at the end of the year. These payments are made quarterly, and are required if you have a tax liability of more than $1,000.00 for the year. For example, if you owe Uncle Sam $1000 at the end of your first year, your advisor may inform you that you must make quarterly payments of $250 the following year.

Sole Proprietorship

A sole proprietorship is an unincorporated business owned by one person. For tax purposes, the business and the individual are the same. As stated above, the business is taxed through the individual who owns the business. The owner pays a self-employment tax, which covers Social Security and Medicare on any profit made.

Partnership

A partnership is a business owned by two or more people who have signed a partnership agreement and have invested either time (sweat equity) or money into the business. The partnership itself doesn’t pay income tax as a company, the partners do so on their individual tax returns. The partnership does have to file an information return that shows the total amount of income, expenses and other deductions, net income of the partnership, and the share of the income attributed to each partner.

Limited Liability Corporation (LLC)

You have the option to set up an LLC a number of ways which will alter how you will be treated by the IRS. You have the choice to identify as a corporation, partnership, or as part of the LLC owner’s tax return. If you’re an LLC owner, you are known as a “member”. In most cases, an LLC with one “member” is known as a sole proprietorship. One with two or more members will be treated as a partnership. An LLC can also file a form with the government and elect to be recognized as a corporation.

Corporation

A corporation is made up of shareholders who own stock in the company. The corporation itself is a separate tax paying entity apart from the shareholders or owners. When a corporation earns income, it pays taxes on that income. When profits are distributed to the shareholders, they must pay taxes on those profits. This is also known as “double taxation”. Corporate income taxes are paid at the corporate income tax rate, which in most cases is lower than the personal tax rate. Shareholders are responsible to pay on their personal income tax rate.

S Corporation

An S corporation is an election made by a LLC or a Corporation that indicates that they want to be taxed utilizing the Subchapter S corporate taxation. This taxation method will allow your profits to “pass through” to the owners of the business. This allows S Corporations to avoid what was described above as the “double taxation” on the corporate income. If you elect to operate as an S corporation, you are required to pay yourself a “reasonable salary”. S corp income is taxable at the owner’s personal income tax rate. C Corporations are responsible for what is described above as “double taxation”.

Self Employment Taxes

Everyone who is employed in the US is responsible for Social Security and Medicare taxes or FICA (Federal Insurance Contributions Act). If you’ve worked for a company, this is what you see taken out of your paycheck weekly, or bi-weekly. Behind the scenes, the company you worked for is required to match your FICA payment.

Essentially, the business is responsible to pay 100% of the FICA tax which is calculated through your employees’ income. However, 50% of that liability falls on the employee, and it’s the employer’s responsibility to withhold their employees required FICA payment based off of what they indicate on their W-4 form. In other words, if your employees paycheck is $1000.00 gross, and they receive $750.00 net (what goes into their bank account) the $250 is paid in taxes. Now, you, as the business owner has to match that $250, which is a total of $500.00 in taxes paid on behalf of that employee.

If you designate as a sole proprietorship, you must still pay the entire 100% FICA tax to ensure that you will still be provided with retirement, disability, survivor and Medicare benefits.

Employment and Payroll Taxes

If you have employees, you have another set of forms to file and taxes to pay. Employment taxes include the FICA payments for Social Security and Medicare, income taxes you withhold from your employees paychecks, and FUTA or (Federal Unemployment Tax)

Remember, as an employer, it is your responsibility to withhold half of the amount from your employees’ income and pay the other half yourself. FUTA is paid separately from income, Social Security and Medicare taxes.

State Taxes

On top of the taxes the federal government requires, state and local governments have their own requirements when it comes to taxation. Similarly, your business’ legal structure will determine how they’re paid. Most states will require payments toward state unemployment and workers’ compensation insurance. Some states like California and New Jersey require contributions toward temporary disability insurance.

If you do business in more than one state, you may be required to pay taxes in each of them, including both income and sales tax.

I hope you now have a general understanding of your tax requirements as a business owner operating ethically and efficiently. If all of this seems overwhelming to you, don’t worry - it was for me to! The good news is, with technology, all of these taxes can be calculated for you and sent to the appropriate entities with the click of a button. You can operate within guidelines, have a sense of certainty, and save a ton of time along the way! I will describe in a later section how to optimize your taxation process in the most efficient way possible.

Understanding Deductions

Having a good understanding of how you can maximize deductions early in your business is a great way to increase profits and efficiency. The IRS allows you to “deduct” certain expenses from your business tax free. Deductions are usually classified as expenses that are directly correlated with running and operating your business. One of the most common deductions is the “mileage” deduction. You are permitted, as a business owner, to deduct a certain dollar amount (fluctuates each year, currently is around $0.53 per mile) that you drive for business purposes. Such as, meeting with a client, running to get supplies, checking on a job site, etc. Nowadays, it’s super easy to track this expense with an app called MileIQ. Click this link to visit MileIQ and to get started with maximizing your deductions.

Here are more examples of what you can deduct in relation to your vehicle:

- Loan or lease payments

- Fuel

- Insurance

- Parking and Tolls

- Repairs

- Registration Fees

Here’s a great list of other deductions for you to consider and keep in mind.

One huge mistake business owners make is not understanding how to strategically spend. Not knowing that wages, materials, and other business related entities are tax-deductible, may stop them from growing their business. We will look more into the “Spend vs. Invest” principle later on, for now, just remember that almost everything related to operating your business is a tax deductible expense.

7. Open Up a Business Bank Account

Having a business bank account is critical to your success in business, and is required in order to legally classify yourself as an LLC or a Corporation. Here’s some more benefits of having a business checking account:

- Builds credibility with your clients (When you have them make a check out to “Blue Hill Painting” as opposed to “John Williams”)

- Helps you or your accountant categorize expenses separate from your personal bank account

- Creates a strong financial foundation for your business

- Eliminates the need to keep receipts, everything is logged online

In order to open up a business bank account, you will need the following:

- Proof of address

- State-ID or driver’s license

- Your EIN number

- Active articles of incorporation from your state’s website

If you have all of those, opening up a business bank account should be easy. Here’s some things you want to look for in choosing the bank that best fits you:

- Location - Try to find a bank that is within 5 miles from your home

- Online banking - Find a bank that offers an easy online banking process, preferably one with an app

- Low fees / Free checking - Many banks charge fees, however, going with a local credit union instead could save you from paying unnecessary fees

- Mobile Deposit - I use this everyday. Find a bank that offers mobile deposit, it will save you a ton of trips to the bank!

When starting your painting business having insurance is a must. There are two types of insurance you need to operate your business. General Liability Insurance, and Workers’ Compensation Coverage. We’ll dive into both:

8. Attain General Liability Insurance

General liability insurance protects you against lawsuits and claims that could arise from operating your business. Some examples would be, and certainly not limited to, overspray, breaking an expensive item in a homeowner’s house, or one of your employees damaging personal property. Typically, a $1,000,000 policy is the standard for smaller residential painting companies (like us!) however, if you plan to get into the commercial side and there's much more potential for liability, don't be shy to raise the policy limit to what makes you feel comfortable.

Generally, General Liability insurance is relatively cheap when you're first starting out. It's calculated based on your anticipated payroll for the upcoming policy term. They will use that amount to assess risk. More Payroll = More Liability. So, you should expect to pay between $60-120 per month (don't quote me, it always changes) for your first year in business.

9. Workers’ Comp Insurance

When I first started my business, I didn’t know much about workers’ compensation. I knew, as a business owner I could “exempt” myself from carrying it. After some great advice from a general contractor, I adopted the coverage for my employees.

In short, Workers’ compensation is a form of insurance that will provide wage replacement and medical benefits to employees injured in the course of employment in exchange for mandatory relinquishment of the employee’s right to sue their employer for negligence.

In other words, if someone falls off a ladder, or roof while working on a job-site, workers’ comp takes the claim as opposed to you having to foot the bill for medical expenses.

Do not take this insurance lightly, because it’s happened! I have had an employee fall off of a ladder, and thankfully he was unharmed. However, he was inches away from his leg being obliterated from the fall. Workers’ comp would have covered all of the medical expenses, and his wage reimbursement if he really did get hurt. I like to call this the “Peace of Mind” insurance.

Another great benefit of being fully insured in both aspects is the pride you feel when homeowners’ ask you for your workers’ comp and insurance liability certification, it will set you apart from the competition! Make sure to use it as a selling point.

Workers’ comp is calculated based off of a rate directly correlated with our profession. Each state varies, so your workers’ comp premium is dependent on where you live.

If you plan on starting out on your own, and want to cut back on some costs, you may be able to apply for an exemption. This means that you are publicly exempting yourself from filing any claim relating to a work-place injury that may happen on your job. A simple Google Search of "Workers' Comp Exemption "Your State" will lead you to the appropriate place to apply.

10. Tap-In To The Power of Outsourcing

Gone are the days where operating your business required hours upon hours of number crunching, paperwork, and confusion. For a small investment, the hard part becomes the easy part.

Outsourcing allows you to truly focus on what matters most - growing your business, selling, and improving your product. I outsource both my accounting and payroll service to maximize my time. I highly recommend considering both options if you want to grow a successful painting business.

Outsourcing Accounting / Bookkeeping

Many businesses fail because of their inability to categorize and maximize the numbers of their business. I knew that this would be a hurdle for me, so I decided to make an investment in an accounting firm to handle all of the numbers for me! I wanted to strictly focus on running and operating my business, and it has truly turned out to be one of my greatest investments.

Oh by the way, hiring an accountant is a tax-deductible expense! Ah, see now you’re getting it!

Many business owners choose the DIY method, and use online software called “Quickbooks” or other online accounting services, but I wanted to avoid the entire process altogether.

I sit with my accountant once a month to go over the figures, numbers, and ways I can improve the efficiency of my business. I pay them a monthly fee, and at the end of the year they file my business tax return, along with my personal tax return ensuring that I am operating within IRS guidelines. Smooth as butter, baby!

The right accountant can also help you mitigate the repercussions of mistakes. When I first started my painting business, I designated myself as an S-Corp. Unknowingly, I hadn’t filed the proper form with the IRS to do so. During my initial consultation with my accountant, they informed me of this error, and filed the form for me, along with a letter asking forgiveness for the delay! This simple act on my behalf gave me complete certainty that I had made the right decision by seeking professional help with an aspect that I wasn’t all to familiar with.

My suggestion is that you find an accountant to help you with your books. They will help categorize those expenses we spoke about above to ensure that you are reporting properly, giving you some more peace of mind! It’s definitely worth it. Remember, in business, time is money. Don't spend time trying to figure out the money, spend time trying to accumulate the money!

Investment : ($75-400/m)

Outsourcing Payroll & Workers' Comp Services

As promised, I will now deliver you the cure-all for the tax confusion! When I first started my painting business, I had the idea that I could

save money

by handling all tax obligations by myself. It took me about 3 weeks to realize I was in over my head! I found myself calculating numbers that I didn't really know how to calculate, writing checks that may or may not have been correct, and wasting incredibly too much time doing so. I also felt a sense of "guilt" that I may not be doing everything the right way.

I learned quickly that this was not my area of expertise, so I did some research and stumbled across a program called Gusto.

Gusto is my personal HR manager. Gusto has solved not only my payroll problems, but my Workers' Comp problems as well!

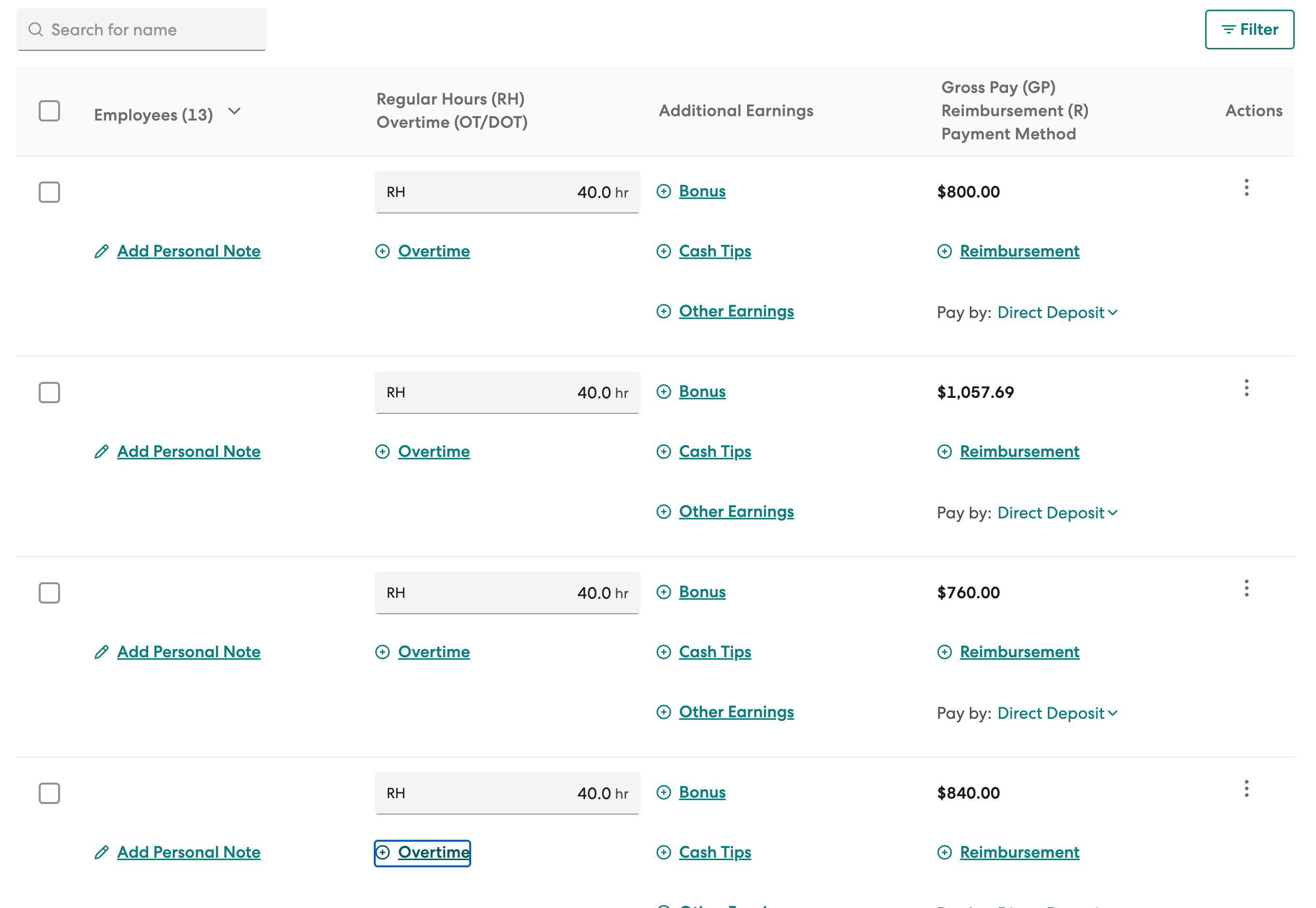

Here's the cool thing about Gusto. It's self serve. All you have to do is do the initial setup, which was extremely easy, then, you're off to the races. Each week, or bi-weekly, you "Run Payroll" and plug in your employee's hours:

As you can see, for each employe (Names hidden for privacy) all I have to do is plug in the hours, and Gusto will automatically calculate their Gross Pay for the week. Once I hit "submit", Gusto will calculate all taxes, pay the corresponding entities, and then pay my employees Direct Deposit.

Workers' Comp through Gusto

After deciding to invest in Workers' Comp, I had more questions than I started with. "Who do I pay?" "How much do I pay?" "How do I pay?"

Gusto made it easy. Gusto affiliates with leading Workers' Comp providers, and because you cut your payroll directly out of Gusto, Gusto knows how much to pay Workers' Comp on your behalf (Because it is usually calculated based on your payroll!"

In other words, I don't have to even think about it.

So, at this point, you probably can guess that we're huge fans of Gusto, so I suggest you sign up and give it a try. Use this link here and you'll receive a free $100 gift card for doing so.

With that said, I highly recommend hiring a payroll service to facilitate your payroll. They will make sure you are operating within federal, state, and local guidelines, along with making sure taxes are being paid to the appropriate entities - so you can focus on growing and managing your painting business! This was a game-changer for me. The small investment (that is tax-deductible!) has paid dividends for me, and my employees.

Investment : $30-70/month (Depending on how many employees you have)

Proper Worker Classification / Paperwork

Another huge benefit of hiring a payroll company to handle your employee paperwork, is that they provide you with up-to-date employee paperwork and help guide you through which paperwork is needed for each employee.

As a business, there is a few ways to pay the people working for you, but first let’s cover how they are “classified”.

-

Employee - One of the most common classifications. As described above, as an employer, you are required and held responsible to pay their share of FICA taxes. You are responsible to carry General Liability insurance and Workers’ Compensation on behalf of your employees.

Paperwork Required: - W-2 Form

- 90-Day Probationary Form

- I-9 Verification (Checks Employment Eligibility)

- Background Check (optional)

- Signed Employee handbook (optional)

-

Independent Contractor - Usually one person. This particular painter will carry their own insurance, and either have a workers’ compensation policy on themselves (rare) or have an “exemption” which exempts them as a “business owner” from carrying the insurance because they’ve decided to opt out.

Paperwork Required - W-9 Form

- Copy of active insurance policy

- Copy of workers’ comp exemption

- Copy of licensing (varies by state)

-

Subcontractor - Usually a business, like yours, with employees. A subcontractor has their own insurance, workers compensation, and most likely has their own employees of which the policies they have cover.

Paperwork Required - W-9 Form

- Copy of active insurance policy

- Copy of workers’ comp exemption

- Copy of licensing (varies by state)

Having a true comprehension of how each category differs could make or break your painting business! These classifications are not to be taken lightly, and as you may already know, misclassifying workers could have serious consequences.

Onboarding a New Employee With Gusto

Onboarding new employees used to be a head-ache. "What paperwork do I need?" "Where do I file it?" "What copies do I need to make?"

Ugh. Not anymore! Gusto has a self-serve "onboarding" portal that makes it easy to bring on a new employee. All you have to do is enter a few basic pieces of information, and Gusto will send an email to them which will allow them to onboard themselves! They will sign all of their necessary paperwork, and give you their bank-account information so they can receive their paychecks. It's literally too easy.

I hope that this has helped give you some clarity on the best approach to starting your own house painting business! Stay tuned to our blog for more updates surrounding all things contracting business as our passion is empowering you to achieve extraordinary heights in your business endeavors!

Don't forget to start your 14-Day Free Trial of DripJobs! The All-In-One business management solution for home-service professionals!